IOL Fluorochemicals Weekly Report: Tariff Cancellation Benefits Supply and Demand, Refrigerant Markets Continue to Run Strong

One week market

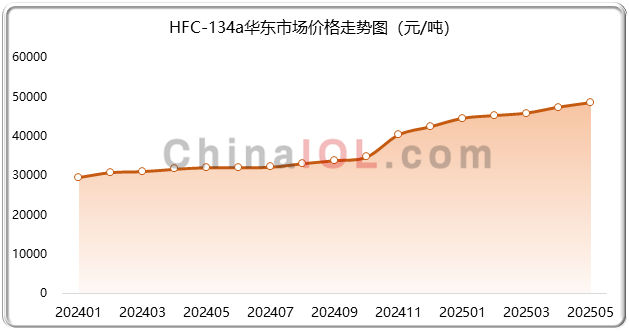

Refrigerant: Tariff cancellation benefits both supply and demand markets, optimistic about peak season and 618 promotion

This week, the downstream refrigerant market is in the traditional peak season, and the market continues to operate strongly. Market characteristics: Upstream basic raw materials such as fluorite powder and hydrofluoric acid have sufficient supply, and prices are temporarily stable; The remaining raw material products are mainly affected by poor overall downstream trading, with narrow fluctuations. Affected by different supply and demand patterns, refrigerant products operate differently. Popular refrigerant products are basically produced at full capacity, while other products are subject to quota control. Factories have a strong reluctance to sell and mainly produce according to demand. Driven by high temperatures, the downstream air conditioning, automotive, and refrigeration industries have entered the peak production season, with increased production and sales supporting strong demand for corresponding refrigerants. It is worth noting that the US has lifted a total of 91% of tariffs imposed on Chinese goods at 00:01 Eastern Time on May 14th, and modified the equivalent tariff measure of 34% imposed on Chinese goods on April 2nd, 2025. Among them, 24% of tariffs will be suspended for 90 days, while the remaining 10% tariffs will be retained. The cancellation of tariffs this time is beneficial for the growth of air conditioning production and sales, and the expected increase in demand during peak seasons will also support the continued high momentum of the refrigerant market in the future.

Fluorinated polymers: phased and structural overcapacity will continue to operate weakly and steadily at a low level

This week, mainstream products in the fluoropolymer market are facing continued expansion, with temporary and structural overcapacity. There is a clear game between the stock and increment of mainstream products, and product prices continue to operate at a low level. Only a few segmented uses are slightly better. Cost end enterprises continue to extend upstream in the industrial chain, filling in gaps and strengthening cost control. The impact of fluctuations in raw material prices on fluorine materials is gradually being digested internally by enterprises. The prices of single products R22 and R142B for raw material use have remained stable for a long time, providing stable cost support for TFE and VDF series products. The downstream application industry on the demand side is facing the contradiction of slow growth in traditional demand industries and fields, and faster supply growth than demand growth in new segmented fields. In summary, due to the slow global economic growth and the high correlation between the growth of demand for mainstream fluoropolymers and economic growth, the future market for fluorine materials will mainly be weakly stabilized in the face of overcapacity constraints.

This Week

01Kemu Company collaborates with Navan Fluoride to develop coolant

Global chemical company Kemu announces strategic partnership with Navin Fluoride International Limited to produce Opteon ™, This is a two-phase immersion cooling fluid designed for advanced data centers and AI hardware, with ultra-low global warming potential (10), nearly 1 power utilization efficiency (PUE), and better performance than traditional cooling methods. It promises to almost eliminate the use of water, reduce space demand by 60%, lower energy consumption by up to 40%, and potentially reduce cooling energy usage by up to 90%. In March of this year, Komu announced a partnership with Japanese IT company NTT Data and engineering company Hibiya Engineering to conduct comprehensive product testing on its new two-phase immersion coolant Opteon 2P50.

02Jinshi Resources: The first overseas base is steadily advancing its pre-processing project and has entered the debugging phase

Recently, Jinshi Resources announced at the 2024 and 2025 Q1 performance briefing that the Mongolian project has completed the stripping and reserve of over 700000 tons of raw ore with a grade of around 25%; Efficiently build a pre-treatment plant and conduct trial production. Starting from April this year, approximately 10000 tons of intermediate fluorite products with a grade of about 40% after pre-treatment and processing have been transported back to Xiangzhen Company for flotation processing; We are actively promoting the construction of flotation plants and supporting water, electricity, etc. It is expected that the equipment installation and commissioning can be completed in June or July.

03Hubei Funolin has officially completed its first round of strategic investment in Fufeng New Materials

Recently, Hubei Funolin New Materials Co., Ltd. (Funolin) officially completed its first round of strategic investment in the emerging industry enterprise Ningxia Fufeng New Materials Technology Co., Ltd. (Fufeng New Materials). This cooperation will deeply integrate Funolin's technological advantages, market advantages, and the industrial chain advantages of Fluorine Peak New Materials, accelerating the breakthrough of high-end fluorine-containing new materials. Through this equity cooperation, Funolin and Fufeng New Materials will deeply bind and empower each other, achieving a strong alliance of market, technology, and resources. Both parties will fully leverage their core advantages and jointly promote the high-quality development of the fluorine-containing new materials industry.

04Huayi Group's Acquisition of 60% Equity in Sanaifu for RMB 4.09 Billion Layout Explanation

On May 9th, Huayi Group participated in the 2024 collective performance briefing for Shanghai state-owned listed companies. At the meeting, Huayi Group stated that this acquisition is a strategic move focused on Huayi Group's key layout in the four new fields of "new energy, new materials, new environmental protection, and new biology". As a fluorine chemical full industry chain enterprise, Sanaifu's fluorine chemical products are the core materials of strategic emerging industries such as new energy and semiconductors. After the completion of this acquisition, the company will better serve emerging application fields such as lithium batteries and aerospace, and effectively enhance Huayi Group's competitiveness in emerging markets such as new energy, new materials, and semiconductors.