IOL Weekly Report: Strong production and sales of air conditioners support high refrigerant prices

one

One week market

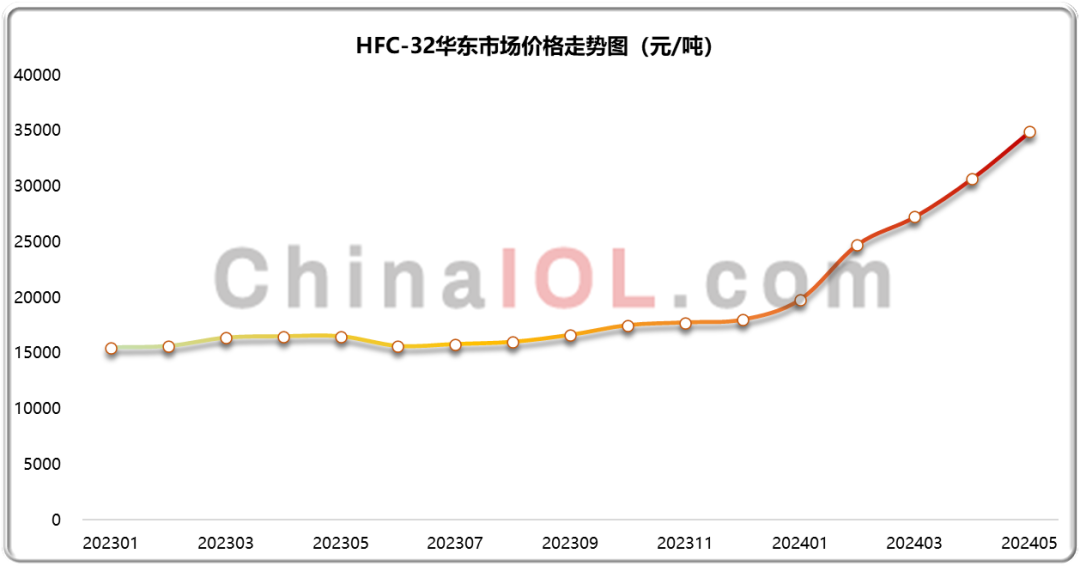

Refrigerant: Strong production and sales of air conditioners support high prices of mainstream refrigerants

This week, the downstream air conditioning industry continued to maintain high levels of vitality, supporting the corresponding refrigerant products to explore and operate. Market characteristics of the week: Raw materials fluctuate, with prices of methane chlorides and calcium carbide experiencing narrow fluctuations. Although prices of other raw material products have slightly fallen, they have already risen to high levels in the early stage, and the cost support for refrigerant products is stable. Due to the peak season of production and sales for air conditioning plants from May to August, the procurement of mainstream refrigerant product R32 in the air conditioning market has increased, and the tight supply in the industry has supported continuous price increases; In addition, as temperatures rise in various regions, the growing demand in the after-sales market stimulates the tight supply and price increase of R22 products; The supply and demand market for other refrigerant products is relatively stable, and prices remain high. Overall, influenced by the different production and sales situations of downstream application industries, the differentiation characteristics of various refrigerant products are obvious. In the peak season market, multiple factors such as tight supply, strong costs, and strong demand will support the stable and rising operation of the future market.

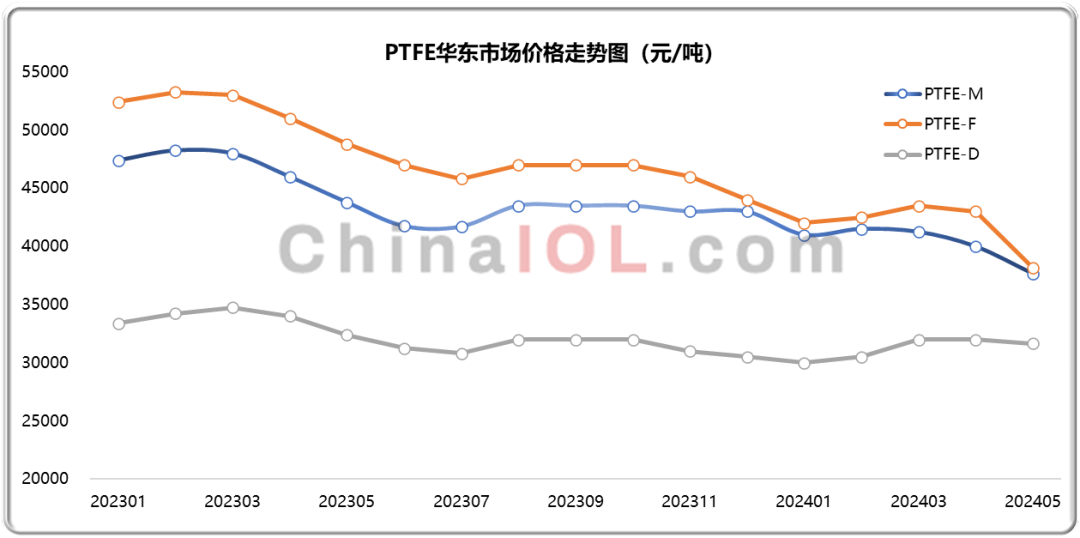

Fluorinated polymers: supply exceeds demand contradiction, prominent cost fluctuations have little impact on prices

This week, the price increase of upstream raw materials in the fluoropolymer market is in stark contrast to the further decline in downstream product prices. The core reason for the sustained weakness and decline in prices is the shift of supply and demand towards the buyer's market. Downstream demand is weak, with on-demand procurement being the main focus; The fluoropolymer factory is under inventory pressure and the equipment is operating at low load. During the week, the price of upstream basic raw material fluorite powder continued to rise, driving up the price of hydrofluoric acid passively. Overall, the cost support for monomer raw material products R22 and R142b increased, leading to increased cost pressure on TFE and VDF series products. Overall, the slowdown in economic growth has led to limited overall demand growth, while the market downturn caused by production expansion needs time to be digested. In the short term, there is a dilemma between the rise and fall of fluorinated polymers, and the bottom will remain weak and stable.

two

Weekly News

one

New Zebang: The Hesford High end Fluorine Fine Chemicals Project (Phase II) has been put into operation

On May 23rd, Xinzhoubang responded on a public interactive platform that the second phase of the high-end fluorine fine chemical project of Hesfu has been put into operation and the product supply is sufficient. It is reported that the investment budget for the high-end fluorine fine chemical project (Phase II) is 525.4158 million yuan, and the construction unit is Haisifu Chemical Co., Ltd. in Sanming City. The main products include 3600 tons of hexafluoroacetone trihydrate, 50 tons of PEVE, 300 PPVE, 1000 tons of trifluoroacetic acid ethyl ester, 217 tons of sodium fluoride, 563 tons of methanol, and 11000 tons of 28% hydrofluoric acid, hexafluoroepoxy propane, hexafluoroisopropanol, as well as 30000 tons of lithium-ion battery electrolyte.

two

The cumulative production of chemical raw materials in China from January to December 2023 was 3.949 million tons

From 2015 to 2023, the production of chemical raw materials in China showed a trend of first decreasing and then increasing. From 2015 to 2017, China's production of chemical raw materials increased from 3.255 million tons to 3.478 million tons. In 2018-2019, under the joint action of stricter environmental and safety supervision and deepening supply side reforms, the production capacity of high energy consuming, high pollution, and outdated production processes for active pharmaceutical ingredients was gradually phased out, resulting in a decline in the production of chemical active pharmaceutical ingredients. With the alleviation of overcapacity in the raw material pharmaceutical industry and the increase in industry concentration caused by the elimination of outdated production capacity, China's production of chemical pharmaceutical raw materials has resumed positive growth since 2020, with an annual production increase of 4.31% year-on-year. The cumulative production of chemical raw materials in 2023 was 3.949 million tons, a year-on-year increase of 8.91%.

three

Environmental Impact Assessment of Hua'an 10000 tons/year Low GWP Fluoroalkene Technical Renovation Project

On May 15th, the Ecological Environment Bureau of Zibo City accepted the environmental impact report of Shandong Hua'an New Materials Co., Ltd.'s 10000 ton/year low GWP fluorinated olefin technical renovation project. The project is located in Zhoucun District, Zibo City, with a total investment of 150 million yuan and a construction period of 12 months. It is planned to renovate the existing 60000 ton/year pentafluoroethane (R125) combined production of tetrafluoroethane (R134a). After completion, the pentafluoroethane (R125) production line will remain unchanged, with a production capacity of 30000 tons/year, retaining 1500 tons/year of tetrafluoroethane (R134a) production capacity (a by-product of the pentafluoroethane production line), and the tetrafluoroethane (R134a) production line will be changed to a 2,3,3,3-tetrafluoropropylene (R1234yf) production line, with a production capacity of 10000 tons.

four

Quanzhou Yuji invests in the construction of 2000 tons of HFO-1336mzz and 170 tons of fluorinated electronic special gas projects

On May 21, Quanzhou Ecological Environment Bureau accepted the Environmental Impact Assessment Report for the construction and upgrading of 2000 tons/year of hexafluoro-2-butene and 170 tons/year of fluorinated electronic special gas production lines. The project has a construction period of 12 months, and the specific products include 2000 tons/year of hexafluoro-2-butene HFO-1336mzz, 100 tons/year of electronic grade hydrogen bromide, 5 tons/year of electronic grade carbonyl fluoride, 5 tons/year of electronic grade trifluoroacetylfluoride, 10 tons/year of electronic grade hydrogen fluoride, 6 tons/year of electronic grade phosphorus trifluoride, 30 tons/year of electronic grade hexafluoro-2-butene, 5 tons/year of electronic grade pentafluoropropylene, and 5 tons/year of electronic grade pentafluoropropylene. Annual electronic grade tetrafluoropropylene and 4 tons/year electronic grade pentafluoropropane.