IOL Fluorochemical Weekly Report: Stability Maintenance of HFC Refrigerants and Observation of Low Level Consolidation of Fluorinated Polymers

One week market

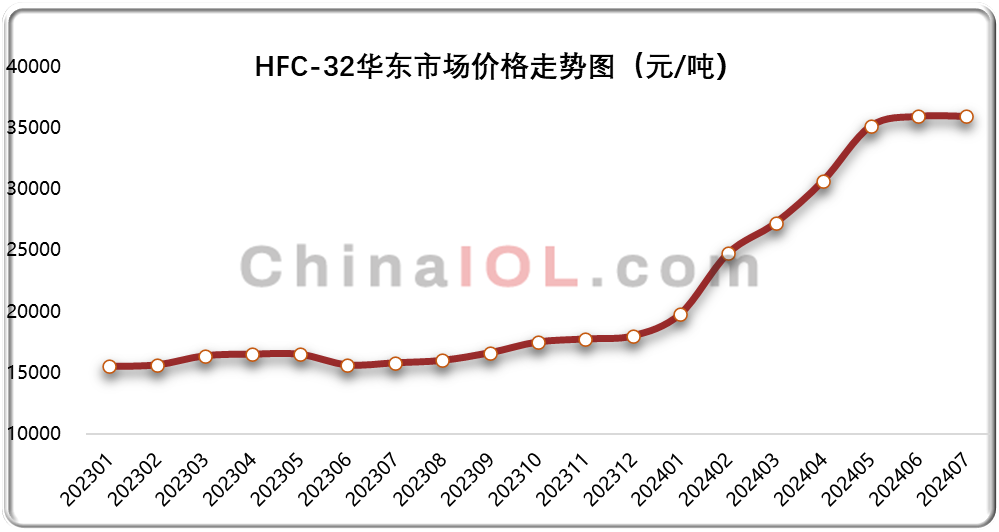

Refrigerant: The pre-sales market for air conditioning has turned weak, and the after-sales and export markets have remained stable. Short term price maintenance remains to be seen

This week, downstream air conditioning industry demand weakened, and refrigerant prices were under pressure and fluctuated. Market characteristics of the week: demand side rigid procurement is the main focus, upstream raw material market shipments are not smooth, prices have fallen more and increased less, prices of calcium carbide and tetrachloroethylene have both decreased, and prices of other products have fluctuated narrowly. At present, the impact of cost side price changes on refrigerant prices is relatively small, and mainstream refrigerant factories maintain normal production. Due to strong demand and limited supply, the R32 and R22 markets continue to operate at a high level, and the pricing of air conditioning factories in the third quarter is synchronized with current prices. As the peak season for downstream air conditioning production ends, the production and sales of other refrigerant products weaken, and factories mainly reduce production to maintain prices. Recently, due to the continuous rainy weather in many parts of the country, downstream home appliance market sales have fallen short of expectations, and the production scale for the third quarter has been reduced. There is still uncertainty in the after-sales market; In addition, the export market mainly relies on essential procurement. Overall, downstream demand is slowing down in the short term, and market inventory needs to be digested. However, refrigerant factories have a strong mentality of reducing production and rising prices. It is expected that under the supply-demand game, prices will continue to be under pressure and fluctuate.

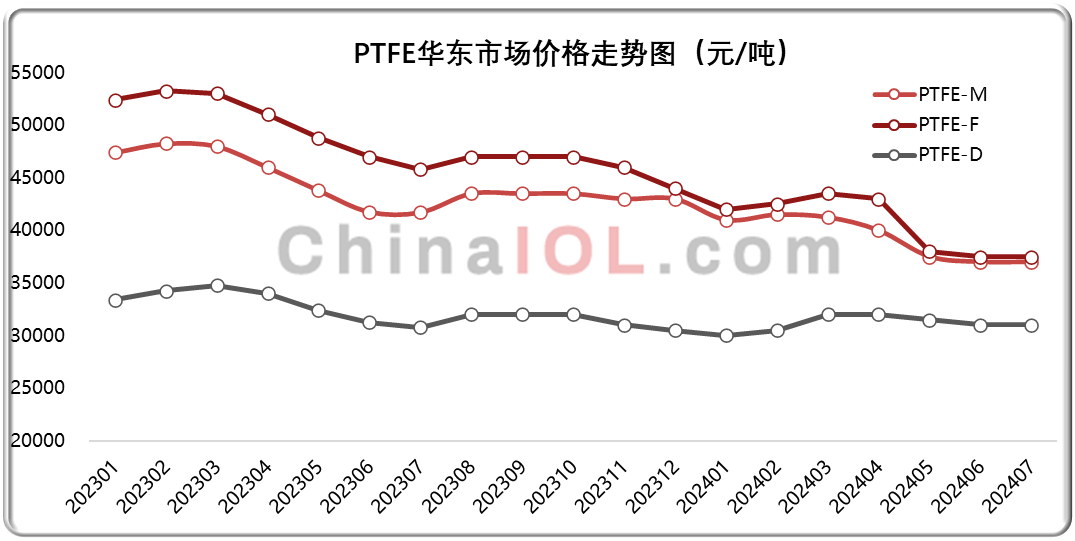

Fluorinated polymers: weak demand forces factories to reduce production and maintain prices at low levels

This week, factories in the fluoropolymer market received orders, scheduled production, and controlled inventory. Both internal and external sales demand remained weak, with stable cost support. Mainstream products operated weakly and steadily. From the perspective of the industrial chain, the prices of upstream basic products such as fluorite powder and hydrofluoric acid are temporarily stable, with short-term pressure to maintain stability; The midstream individual products R22 and R142b continue to have strong cost support, while the market for controlled use and raw material use continues to be volatile. The market for controlled use is strong, while the market for raw material use is facing production and sales setbacks, and prices are deadlocked near the cost line; The overall growth rate of downstream application industries has slowed down, which is reflected in the end market where product processing enterprises mainly purchase on demand, and demand is difficult to improve, forcing factories to reduce production to maintain prices. Overall, the current weak demand in the fluoropolymer market has led to supply side factories reducing production to maintain prices. The TFE and VDF series of new and old products have collectively entered a deep consolidation stage, with prices continuing to operate in a low game.

Weekly news

01

As of the end of June 2024, the total number of new energy vehicles in China was 24.72 million

According to statistics from the Ministry of Public Security, as of the end of June 2024, the total number of motor vehicles in China reached 440 million, including 345 million automobiles and 24.72 million new energy vehicles; There are 532 million motor vehicle drivers, including 496 million car drivers. In the first half of 2024, there were 16.8 million newly registered motor vehicles and 13.97 million newly licensed drivers nationwide.

two

China's National Plan for Implementing the Montreal Protocol on Substances that Deplete the Ozone Layer (2024-2030) (Draft for Comments)

On July 2nd, the Ministry of Ecology and Environment issued a letter soliciting opinions on the National Plan for China's Implementation of the Montreal Protocol on Substances that Deplete the Ozone Layer (2024-2030) (Draft for Comments). The draft for soliciting opinions includes control measures for ozone depleting substances in terms of source control, process control, end of pipe treatment (maintenance, recycling, reuse, and destruction), and import and export. The release of this draft opinion can provide guidance for relevant industries to better implement the Vienna Convention for the Protection of the Ozone Layer and the Montreal Protocol on Substances that Deplete the Ozone Layer.

03

Huaxin Mining Group enters the fluorite industry

On July 1st, Huaxin Mining Group, a subsidiary of Huaxin Construction Investment Group, held a cooperation signing ceremony with the mining rights holder of Xingji Fluorite Mine, marking the launch of the integration work of Pingqiao Xingji Fluorite Mine by Huaxin Mining Group and its official entry into the fluorite mine and its industry. The person in charge of Huaxin Construction Investment Group stated at the signing ceremony that after the completion of the merger and acquisition, the group will first improve the mining and beneficiation industry of fluorite ore, ensure the supply of ore, produce high-quality block ore and refined powder, then develop the hydrofluoric acid preparation industry, so that it has the foundation to expand into the fluorine chemical industry, and finally further extend to various fluorine chemical products.

04

Yongjia Group's Fluororesin, Fluororubber, and Fluorobased Special Materials Project Landing in Anqing

On the morning of May 16th, the signing ceremony for Yongjia Group's fluororesin, fluororubber, and fluorobased special materials projects was held. The contracted project is located in Anqing High tech Zone and plans to build an annual production capacity of 40000 tons of polyvinyl fluoride and 45000 tons of fluorine based monomer materials. The total investment of the project is 5.5 billion yuan, with a land area of about 641 acres and an annual output value of no less than 7 billion yuan after reaching production capacity. Among them, the project product polyvinyl fluoride is widely used in battery separators, battery adhesives and other fields, and more than 90% of China's products rely on imports; After the completion of this project, it will fill the gap in the domestic market for new battery materials, achieve domestic substitution of bottleneck materials, and create a new energy sector for our city

05

Environmental Impact Assessment of Jiangxi Liwen Trifluorochloroethylene CTFE and Supporting Projects

On July 3rd, the Ruichang Ecological Environment Bureau of Jiujiang City accepted and publicly announced the environmental impact assessment of the trifluorochloroethylene and supporting projects of Jiangxi Liwen Chemical Co., Ltd. Due to the completion of a 20000 ton/year HCFC-22 (R22) plant by the company, chloroform is used as the raw material and reacted with chlorine gas and hydrofluoric acid under the action of a catalyst to prepare it, which is extremely similar to the preparation process of R113. The project plans to transform the R22 unit with an annual output of 20000 tons through technological transformation, enabling it to flexibly produce R113 and R22, and supporting the construction of a 10000t/a CTFE unit, producing 1000t/a of trifluoroethylene (TrFE).