IOL Fluorochemical Weekly Report: Refrigerant Factory Reduces Production, Stabilizes Prices, Pressure and Fluctuations

One week market

Refrigerant: Air conditioner production and sales enter off-season, refrigerant factories synchronously reduce production and maintain stability

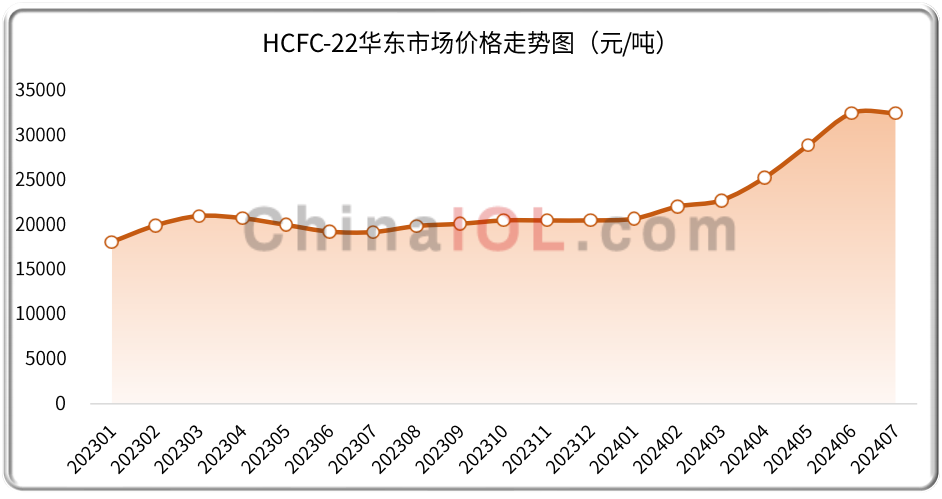

This week, the overall production and sales of the refrigerant market remained stable and volatile. Market characteristics of the week: Entering July, air conditioning production and sales enter the off-season, with the market mainly focused on essential purchases. Upstream raw material market transactions are weak, and prices fluctuate narrowly, with price changes within 5%. Currently, the impact of cost side price changes on refrigerant prices is relatively small, and mainstream refrigerant factories maintain normal production. According to Industry Online data, the year-on-year growth rate of household air conditioning production and sales in June was around 4%, but exports increased by 46% year-on-year. Although production and sales in the downstream air conditioning market have weakened and demand has slowed down, overall demand support is stable, and R32 and R22 refrigerant prices remain stable; Individual refrigerant products have been affected by weak demand, resulting in lower prices and a strong mentality of factories reducing production to maintain price increases. It is expected that under the supply-demand game, refrigerant prices will continue to fluctuate under pressure.

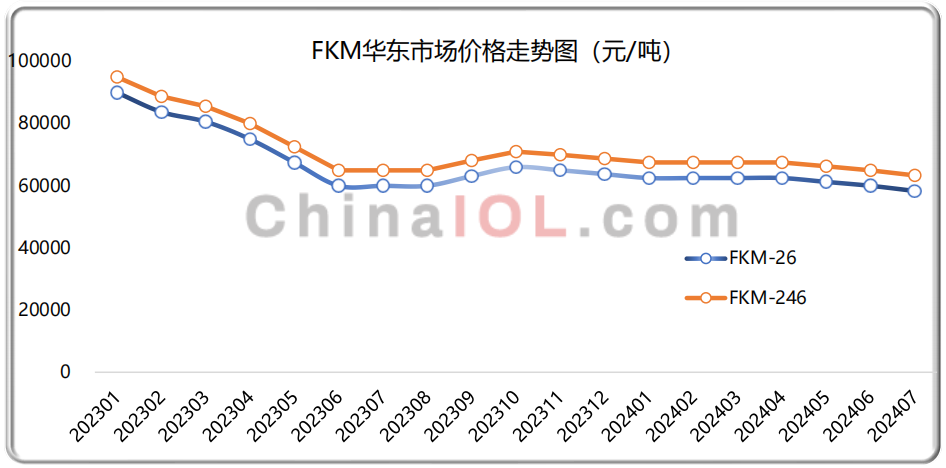

Fluorinated polymers: little improvement in supply and demand, prices close to cost line operation

This week, the fluorinated polymer market continued the weak bidding and shipping trend, with poor shipments leading to factory production cuts and price protection. The overall capacity utilization rate of the industry has decreased, and some products are facing serious overcapacity. Mainstream products are facing internal competition to the brink of losses, and prices will continue to be low and weakly stable. From the perspective of the industrial chain, upstream basic products such as fluorite powder, hydrofluoric acid, and methane chloride are also facing price pressure and shipping difficulties, while overall cost support for downstream products remains stable; The self-sufficiency rate of midstream monomer products R22 and R142b in terms of raw material usage has significantly increased, and prices are deadlocked near the cost line; The slowdown in demand growth in downstream application industries has led to corresponding fluorine material processing enterprises purchasing on demand and reducing stockpiling, which is also an important reason for the relatively poor demand in factories. Overall, the current supply-demand relationship in the fluoropolymer market has not improved significantly, and cost fluctuations remain low. The weak and stable market trend of oversupply will continue in the future.

Weekly news

01Hua'an New Materials and Jin'ebo Fluorine Chemical have reached a cooperation agreement on anhydrous hydrogen fluoride

On July 10th, Inner Mongolia Jin'ebo Fluorine Chemical Co., Ltd. and Shandong Hua'an New Materials Co., Ltd. officially signed the "2024 Strategic Cooperation Framework Agreement for Anhydrous Hydrogen Fluoride". Both parties will take this signing as an opportunity to fully leverage their respective resources and technological advantages, strengthen the linkage of the chemical industry, and work together to promote the high-quality development of the domestic chemical industry. It is reported that Inner Mongolia Jin'ebo Fluorine Chemical Co., Ltd. is a joint venture established by Jinshi Resources, Baosteel Group, Yonghe Group, Longda Group, etc. Its business scope includes the production of fluoride using fluorite powder. Previously, the company's investment projects included the "Flexible Joint Production of 360000 tons/year Anhydrous Aluminum Fluoride and 180000 tons/year AHF Project" and 2 x 400000 tons/year sulfuric acid supporting production facilities.

02Jinshi Resources: Jin'ebo Fluorine Chemical's Anhydrous Hydrogen Fluoride Project produces approximately 10000 tons per month

On July 16th, Jinshi Resources released an investor relations activity announcement. In this event, the company answered questions about the market pattern of fluorite, the current progress of project investment in Mongolia, and the progress of various projects: the company has 8 single mines with an annual output of about 400000 to 500000 tons, the Baotou project has an output of 500000 to 600000 tons, and the national annual output is about five to six million tons; The Mongolian project aims to be completed this year according to the original plan; The Baosteel beneficiation project is progressing according to plan, the Jin'ebo Fluorine Chemical Anhydrous Hydrogen Fluoride project has a production schedule of approximately 10000 tons per month, and the sulfuric acid project is tentatively scheduled to be completed and installed around August this year.

03Shengjing Yingke Fluoropolymer Materials Integrated Construction Project Completed Filing

On July 17th, the Inner Mongolia Shengjing Yingke Fluorine Chemical - Fluorine based Polymer Materials Integrated Construction Project completed its filing. The project has a total investment of 1.2 billion yuan and is divided into three phases of construction. The first phase will build a flexible joint production 30000 tons/year anhydrous hydrogen fluoride production line, 10000 tons/year electronic grade hydrofluoric acid production line and supporting engineering, the second phase will build a 20000 tons/year difluorochloromethane (R22) production plant, 10000 tons/year tetrafluoroethylene (TFE) production line and supporting engineering, and the third phase will build a 5000 tons/year polytetrafluoroethylene (PTFE) production line, a 5000 tons/year meltable polytetrafluoroethylene (PFA) production line and supporting engineering. The construction period is from March 2025 to December 2030.

04Gansu Minghe New Materials 1000 ton Perfluorohexane Project Announcement

On July 15th, Gansu Minghe New Materials Co., Ltd. released the draft environmental impact assessment for the 1600 ton annual production of high-performance fluorine-containing functional materials project in Zone C of the specialized and innovative chemical industry incubation base in Lanzhou New Area. The project has a total investment of 30.38 million yuan and plans to build a 1000 ton/year perfluorohexane production line, a 582.29 ton/year electronic chloride liquid production line, and a by-product of 314.86 tons/year sodium chloride.

05Jiangxi Huate renovation and expansion project contains 1300 tons of fluorinated special gas

On July 17th, the Ecology and Environment Bureau of Jiujiang City issued a notice stating that it has made an approval decision on the environmental impact assessment document for the annual production of 1936.2 tons of electronic special gas project in Huate Yongxiu, Jiangxi. It is reported that the project was accepted on June 7th with a total investment of 174 million yuan. The construction includes 300 tons/year of perfluorobutadiene C4F6 and 1000 tons/year of nitrogen trifluoride units.