What is the import and export situation of fluorocarbon chemicals in China in the first half of 2024?

1、 Overall import and export situation of refrigerant

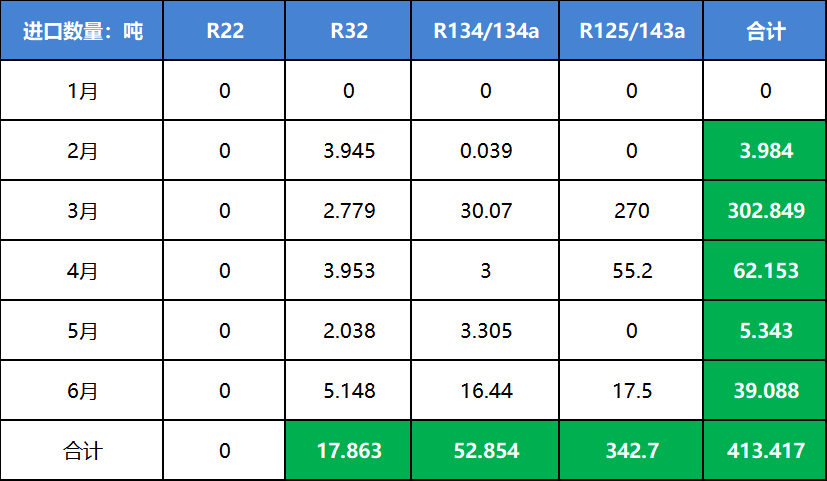

China is a major producer and exporter of fluorocarbon chemicals, with exports being the main focus and imports being relatively small. From January to June 2024, the import quantities of major fluorocarbon chemicals R22 (tariff code 29037100), R32 (tariff code 29034200), R134/34a (tariff code 29034500), and R125/143a in China are still relatively small, as follows:

The total export volume of fluorocarbon chemicals under the four tariff codes mentioned above in June was 29341.204 tons, an increase of 15.63% month on month and 9.82% year-on-year; The total export volume from January to June was 124129.711 tons, a year-on-year decrease of 13.44%, with R125/143a showing the most significant decrease, reaching 44.31%.

Figure 1: Statistics of China's fluorocarbon chemical exports from January to June 2024

2、 R22 import and export situation

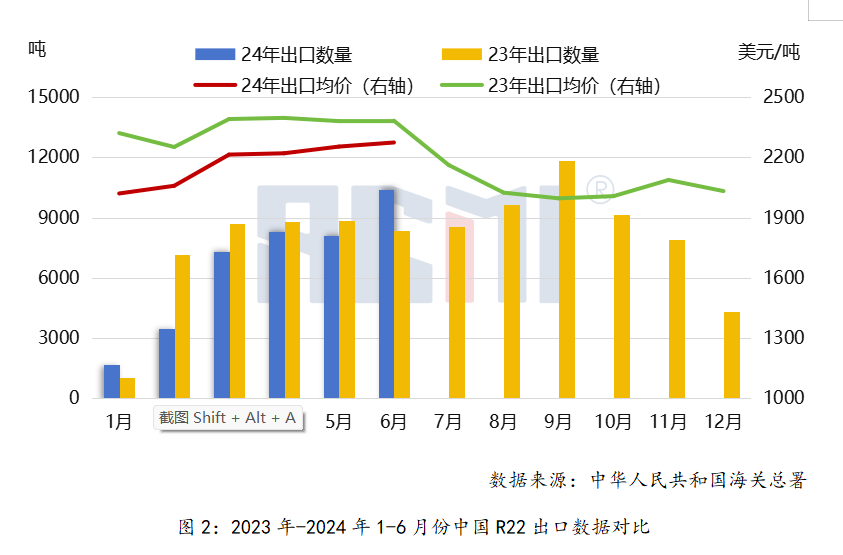

The export quantity of R22 in June was 10414.699 tons, an increase of 28.76% month on month and 24.70% year-on-year; The export amount was 23.68722 million US dollars, an increase of 29.92% month on month and 19.02% year-on-year; The total export volume of R22 from January to June was 39337.156 tons, a decrease of 8.4% compared to the same period last year.

In terms of average export price, the overall trend from January to June showed a monthly increase, which is consistent with the continuous rise in domestic prices, but the overall price level is lower than last year.

Figure 2: Comparison of China's R22 export data from January to June 2023 to 2024

3、 R32 import and export situation

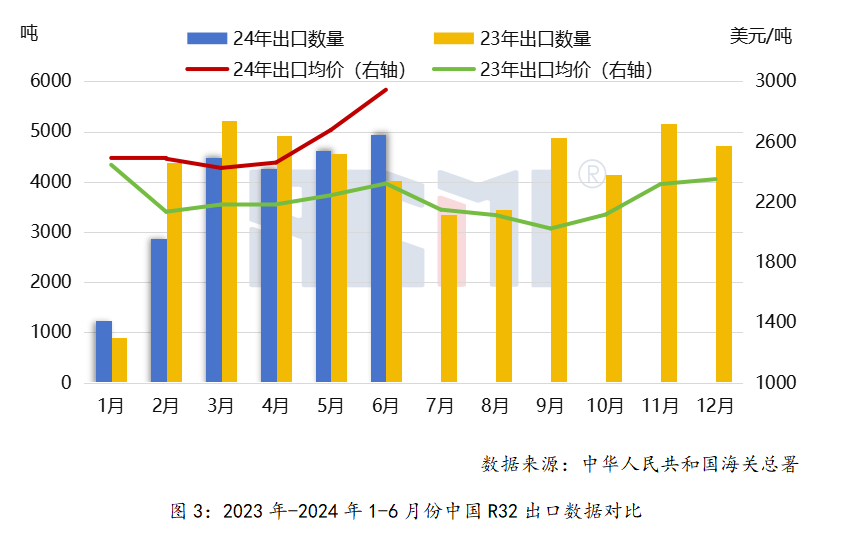

The export quantity of R32 in June was 4938.433 tons, an increase of 6.69% month on month and 22.94% year-on-year; The export amount was 14538952 US dollars, an increase of 17.30% month on month and 55.88% year-on-year; The total export volume of R32 from January to June was 22395.624 tons, a decrease of 6.6% compared to the same period last year.

In terms of export average price, the monthly average price trend from January to June is also consistent with the domestic price trend, showing an upward trend, especially in May and June where the increase is significant, and the overall price level is higher than the same period last year. The increase in export prices is not only boosted by the rise in domestic prices, but also driven by foreign demand.

4、 Import and export situation of R134a/134

The export quantity of R134a/134 in June was 12834.437 tons, an increase of 13.83% month on month and 1.54% year-on-year; The export amount was 50.640424 million US dollars, an increase of 16.75% month on month and 15.84% year-on-year; The total export volume of R134a/134 from January to June was 56188.422 tons, a decrease of 14% compared to the same period last year.

In terms of export average price: From January to June, there was an overall trend of increasing month by month, with a slightly smoother price change compared to R22 and R32. Compared with last year, the overall price was higher than the same period last year.

Figure 4: Comparison of China's R134/34a Export Data from January to June 2023 to 2024

5、 Import and export situation of R125/143a

The export quantity of R125/143a in June was 1153.635 tons, a decrease of 16.52% month on month and 32.47% year-on-year; The export amount was 3.717749 million US dollars, a decrease of 19.10% month on month and 35.75% year-on-year; The total export volume of R125/143a from January to June was 6208.509 tons, a decrease of 44.31% compared to the same period last year.

In terms of average export price, the monthly average price increased month by month from January to April, but fell back in May and June, and the overall price was lower than the same period last year. This is mainly due to the impact of changes in demand structure, where export data decreased while prices also decreased.

Figure 5: Comparison of China's R125/143a export data from January to June 2023 to 2024

6、 Situation of export trading partners

From the perspective of export trading partners, the top three countries and regions for R22 exports from January to June are Japan, the United Arab Emirates, and South Korea; The top three countries and regions in terms of R32 export quantity are Thailand, the Netherlands, and Brazil; The top three countries and regions in terms of export quantity of R134/34a are the United Arab Emirates, Mexico, and Brazil; The top three countries and regions in terms of export quantity of R125/143a are the United States, the Netherlands, and India. The top ten countries and regions in terms of export trading partners for refrigerant products from January to June are shown in the table below: